Unlocking the Potential of Whisky Investment

Whisky investment has gained significant attention due to its lucrative market and potential for portfolio diversification. Rare whisky has delivered impressive returns, with a 564% increase over the past decade, outperforming many other alternative investments. This demonstrates the potential for substantial financial gains in the whisky market. Moreover, private investors now have opportunities to access this market through platforms like WhiskyInvestDirect, enabling them to purchase whole casks and participate in a previously exclusive market.

Expert opinions also support the notion that whisky is an intriguing investment asset for both current and future investors. With these factors in mind, it's clear that whisky investment offers unique opportunities for those looking to diversify their portfolios and explore new avenues for financial growth.

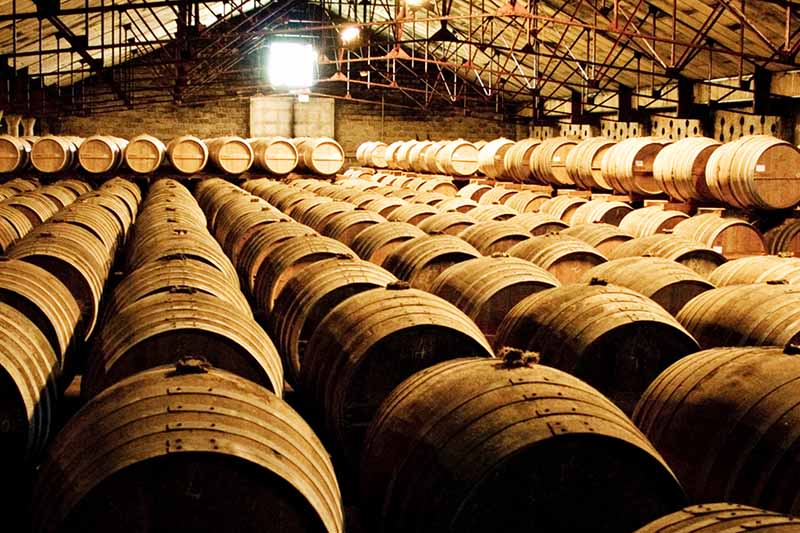

The Lucrative Whisky Market

Whisky as a Lucrative Investment

The whisky market has demonstrated its potential as a lucrative investment, with rare whisky delivering impressive returns over the past decade. For instance, rare whisky has outperformed traditional investments such as the S&P 500 index, which returned only 340% over the same time period. Moreover, the global whisky market had an estimated worth of nearly $58 billion in 2021, indicating substantial growth and value within the industry. Additionally, specific examples like the sale of a bottle of The Macallan Valerio Adami 1926 60-year-old for $1.1 million highlight the extraordinary value that certain whiskies can attain.

Investing in whisky also offers stability and long-term potential, with opportunities for private investors to purchase whole casks and participate in this thriving market. Platforms like Spiritory have democratized access to quality whiskies, allowing investors to engage in this previously exclusive market without minimum investment requirements or holding periods. Furthermore, investing in whiskies from lost distilleries is considered a safe investment strategy, offering a level of stability due to their scarcity and historical significance.

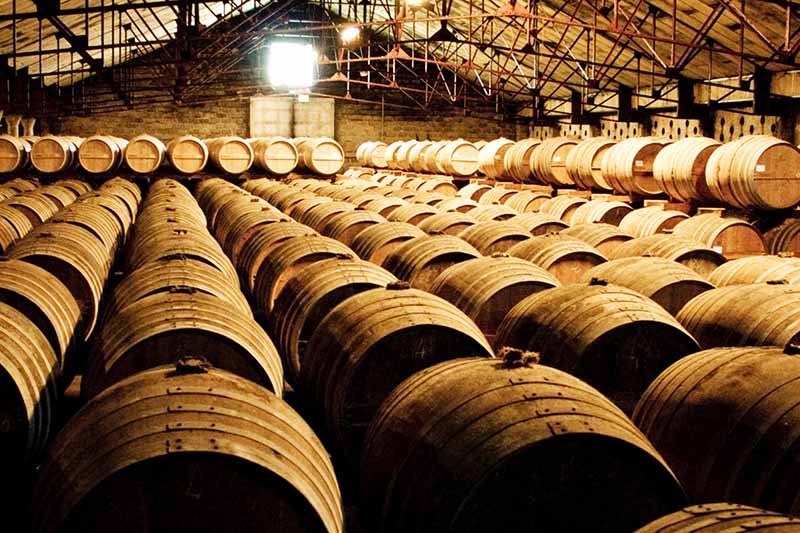

Private Investing and Whisky Market Dynamics

Rupert Patrick, Co-founder & Chairman of WhiskyInvestDirect, emphasizes the importance of experienced guidance when investing in Scotch whisky. His expertise underscores the complexities and nuances of navigating this market successfully. With consistent export values and average returns ranging from 8% to 12% per year for Scottish whisky, it's evident that whisky investment presents compelling opportunities for both seasoned and novice investors.

The combination of impressive historical returns, global market worth, and accessibility for private investors positions whisky as an attractive asset class for diversifying investment portfolios.

Factors Influencing Whisky Investment

Key Characteristics of Whisky Investment

Whisky investment is influenced by several key characteristics that contribute to its impressive performance. The average return of whisky, approximately 14.4%, highlights its potential for substantial financial gains. Additionally, the total whisky market is projected to reach around $85 billion by 2026, underscoring the industry's growth and value. Furthermore, whisky has statistically outperformed other alternative investment classes such as watches, classic cars, and art over the past decade.

The role of scarcity and uniqueness in whisky investment cannot be overstated. For instance, a Glenfiddich Single Malt with four decanters from the 1950s fetched nearly 1 million euros at an auction, setting a new record for Glenfiddich. These examples emphasize how scarcity and uniqueness significantly contribute to the value and desirability of certain whiskies.

Risk and Reward in Whisky Investment

Investing in whiskies from lost distilleries is considered relatively safe due to their historical significance and scarcity. For example, bottles from distilleries no longer in operation are often sought after by collectors and enthusiasts, providing a level of stability within this investment class. However, considerations for investing in whiskies from new distilleries require careful evaluation of factors such as brand reputation and long-term potential.

Comparing the whisky market with other luxury goods markets reveals its exceptional performance as an alternative investment class. The consistent growth and returns within the whisky market position it as a compelling option for investors seeking diversification.

Whisky Investment Strategies

Age, limited editions, and quality play pivotal roles in determining the value and investment potential of whiskies. Additionally, comparing whisky with other alternative investment classes underscores its favorable performance over traditional options.

Balancing whisky investment within a diversified portfolio allows investors to leverage the unique benefits offered by this asset class while mitigating risk through strategic allocation.

Embracing Whisky Investment for a Diversified Portfolio

Whisky investment presents an enticing opportunity to diversify investment portfolios and unlock substantial financial potential. The impressive average return of approximately 14.4% and the projected growth of the whisky market to $85 billion by 2026 underscore its lucrative nature. Including whisky in an investment portfolio offers diversification benefits, as it has historically outperformed traditional alternative investment classes such as watches, classic cars, and art. To succeed in whisky investment, strategies such as considering the role of age, limited editions, and quality are crucial for making informed decisions.

In conclusion, embracing whisky investment as part of a diversified portfolio can provide investors with unique opportunities for wealth accumulation and risk mitigation.

See Also

The Craft Irish Whiskey Co. Achieves Record $2.8 Million Sale of The Emerald Isle in 2024

Leave a comment